san francisco payroll tax rate

Determine non-taxable San Francisco payroll expenses. The Administrative Office Tax AOT is a 14 percent tax on the San Francisco payroll expense of a person or combined group engaging in business within San Francisco as.

Due Dates For San Francisco Gross Receipts Tax

The taxpayer may calculate the amount of compensation to owners of the entity subject to the Payroll Expense Tax or the taxpayer may presume that in addition to amounts reported on a W-2 form the amount subject to the payroll expense tax is for each owner an amount that is two hundred percent 200 of the average annual compensation paid to on behalf of or for the.

. The City of San Francisco City has issued the payroll expense tax rate for 2019 which is unchanged from the prior year at 0380. The rate of the payroll expense tax shall be 1½ percent. Over 50 of the total combined San Francisco payroll expense of that person and its related entities for the preceding tax year was associated with providing administrative or management services exclusively to that person and its related entities.

The tax is calculated as a percentage of total payroll expense based on the tax rate for the year. The amount of such tax for Associations shall be 1½ percent of the payroll expense of such Association plus 1½ percent of the total distributions. What is the San Francisco Gross Receipts Tax.

The san francisco office of the controller city and county of san francisco announced that for tax year 2018 the payroll expense tax rate is 038 down from 0711 for 2017. Line 4 San Francisco Payroll Expense Tax before credits The system will calculate your payroll expense tax before credits 038 of your Net San Francisco payroll expense. Payroll tax of 328 on payroll expense attributable to the City5 Commercial Rents Tax Effective January 1 2019 San Francisco joins the New York City borough of Manhattan in imposing a commercial rents tax6 Unlike Manhattan San Franciscos Commercial Rents Tax will be imposed on the landlord not the.

San Franciscos payroll expense tax was set to fully phase out in 2018 after the phase-in of the Citys gross receipts tax. Gross Receipts Tax and Payroll Expense Tax. 14 San Francisco Business and Tax Regulations Code Article 12-1-A 953.

Payroll tax revenues are derived from a tax on the payroll expense of persons and associations engaging in business in San Francisco. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan.

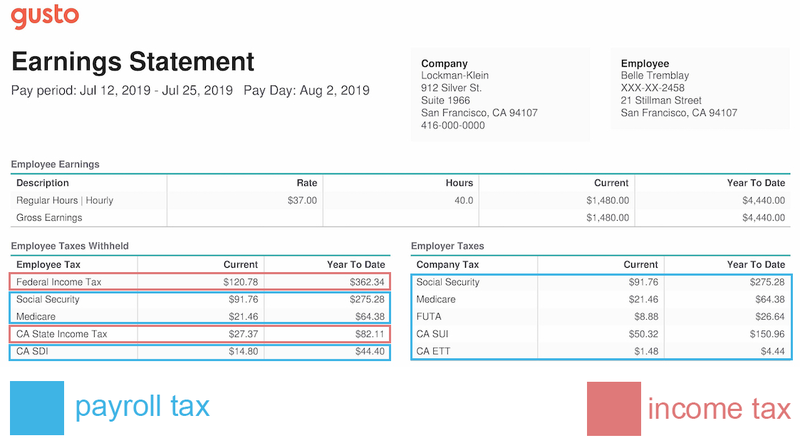

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. Proposition F eliminates the payroll expense tax and replaces it by increasing the gross receipts tax rate across all industries effective Jan. Both employers and employees are responsible for payroll taxes.

Payroll expense tax rate for 2017 dear treasurer cisneros. Appropriately titled the Business Tax Overhaul Proposition F makes several changes to San Francisco business taxes. Filing Due Dates The 2017 gross receipts tax and payroll expense tax return is due February 28 2018.

City and County of San Francisco. To avoid late penaltiesfees the return must be submitted and paid on or before April 30 2021. Tax Rate Allocation The tax rate is 15 percent of total payroll expenses.

San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. This position is responsible for bi-weekly payroll processing for a growing multi-state organization including but not limited to new hires terminations bonuses. The San Francisco Annual Business Tax Return Return includes the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Early Care and Education Commercial Rents Tax and Homelessness Gross Receipts Tax.

To compute the tax. Determine total San Francisco payroll expenses. Line 1 Line 2.

File your Annual Business Tax Returns 2019 Instructions. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are applicable to the city of San Francisco in the state of California. San Francisco was the only city in California to base its business tax on payroll expense.

Lean more on how to submit these installments online to comply with the Citys business and tax regulation. For example tax rates for the highest marginal rate applicable to the Information Services industry will rise from 0475 percent to 0879 percent from 2021 to 2024. Line 3 Net San Francisco payroll expense The system will calculate the net San Francisco payroll expense.

Certain taxpayers engaged in administrative office business activities are not subject to the GRT or the payroll tax but instead pay a 14 tax on total payroll expense. Payroll Expense Tax Rate The payroll expense tax rate for tax year 2017 is 0711 down from 0829 for tax year 2016. City and county of san francisco room 140 city hall re.

Until the passage of Proposition E San Francisco levied a 15 tax on the payroll expense of larger businesses in the city. Payroll benefits hr and more. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

Solid experience with local state and federal payroll and tax laws Skill in handling workload fluctuations and multiple requests Advanced level of proficiency using Microsoft Office V-lookups and Pivot tables Knowledge and mindset for automation and improvements to improve processes for scalability. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. To avoid late penaltiesfees the returns must be submitted and paid on or before March 2 2020.

Proposition F repeals the payroll expense tax as of January 1 2021. Repeal of payroll expense tax. The amount of a persons liability for the payroll expense tax shall be the product of such persons taxable payroll expense multiplied by 0015.

Payroll Tax Vs Income Tax What S The Difference The Blueprint

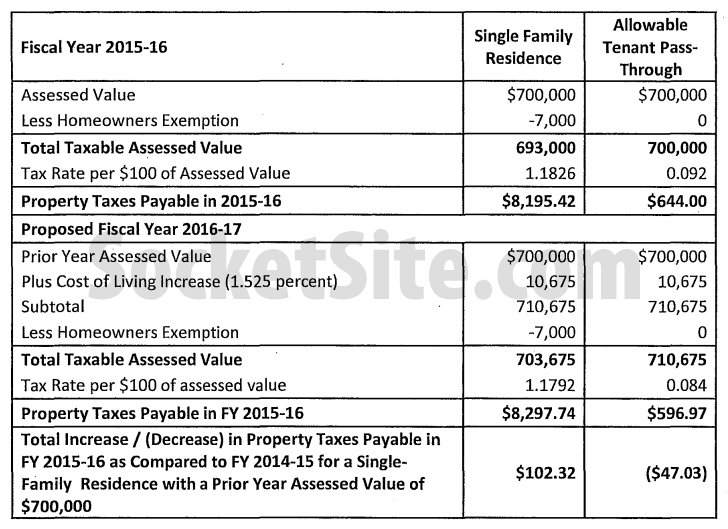

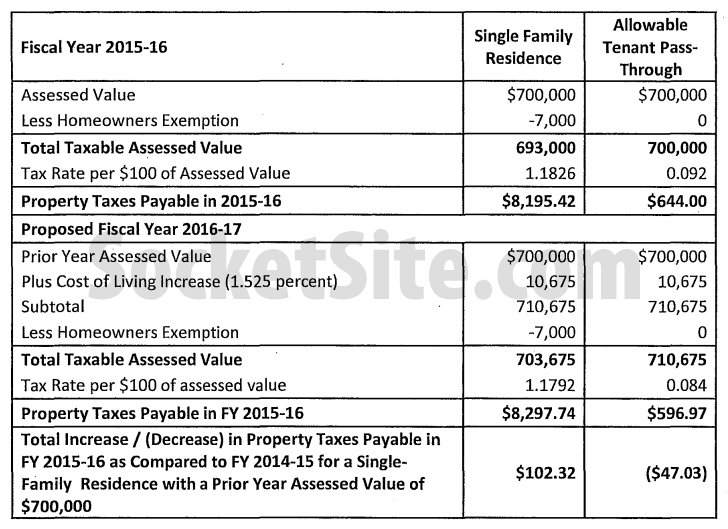

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

Annual Business Tax Return Treasurer Tax Collector

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Annual Business Tax Return Treasurer Tax Collector

Annual Business Tax Returns 2020 Treasurer Tax Collector

2022 Federal State Payroll Tax Rates For Employers